Over the last few months there has been a huge increase in environmental compliance duties globally , to the point where, in the near future, all companies listed on international stock exchanges would have to publish their greenhouse gas emissions and explain the initiatives they are taking to reduce them.

The most notable recent news is the regulation proposal issued by the United States Securities and Exchange Commission (SEC) on March 21, 2022. If this regulation is approved, it would oblige all companies listed on the United States stock exchange, to be published:

- Your greenhouse gas emissions.

- The environmental goals that the company has, including the dates and the process to meet them.

- The experience and role of the members of the Board of Directors to face the challenges of climate change.

- Determine the risks that climate change may have on the company.

Despite the huge impact its approval would have, the SEC’s proposed rule is only part of a global trend that points to greater involvement by companies to fight climate change.

According to the OECD , 15 G20 countries have regulations that require companies to publish environmental reports on a regular basis and require the quantification of carbon emissions. Among them, the United Kingdom and Japan have been reforming their regulatory schemes so that, as of April 2022, more and more companies are obliged to publish reports on their shares and their exposure to climate change.

For its part, the European Union, which already requires large companies and financial entities to report the way they handle social and environmental challenges, proposed new rules that would expand the scope of this regulation so that it applies to all companies listed on the stock exchange. , or that meet certain size and income parameters.

Implications of international environmental compliance duties for Latin America :

The aforementioned regulation, despite coming from other countries, will have a great impact on Latin America, since the duties of publishing information related to climate change usually include the subsidiaries that companies from said countries have in the rest of the world.

Additionally, it is estimated that these duties will fall indirectly on local businesses, since it is expected that companies from countries such as the United States, the European Union and the United Kingdom choose suppliers that meet these standards, in order to facilitate regulatory compliance and achievement of the emission reduction goals of its operations.

Greater value will be given to companies that already have experience demonstrating their emission reduction:

Due to the high scrutiny that companies in the United States and Europe have received regarding the transparency and accuracy of their reports on climate change, large companies will prioritize providers that have the most experience reporting their emissions transparently.

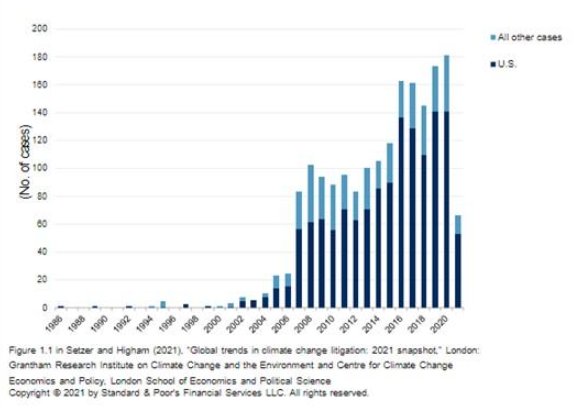

In the last decade, lawsuits related to climate change have increased exponentially, and many of these have had to do with the information that companies have published regarding their climate footprint and proposed reduction plans.

Global trends in climate change litigation: 2021

Additionally, 58% of the judicial cases mentioned have obtained sentences ordering greater transparency and action by companies and governments to face climate change. In contrast, only 32% of the cases have obtained unfavorable sentences for organizations that advocate for climate action.

Faced with such clear figures, it is to be expected that the top managers of the companies will make great efforts to ensure that all the actors in their business chain comply with the new standards.

We are at a stage where companies must pay more attention to their environmental impacts, not only to have a better image before the public, but also to comply with new regulations to combat climate change, whose trend is clearly increasing.

As has happened throughout history, changes in standards present great opportunities for companies that are prepared to adopt them and even take advantage of them, but they also pose great risks for those businesses that do not adapt to the new market conditions.